Excise Duty In India

Chief Minister Himanta Biswa Sarma announced the. Excise duty is a form of tax imposed on goods for their production licensing and sale.

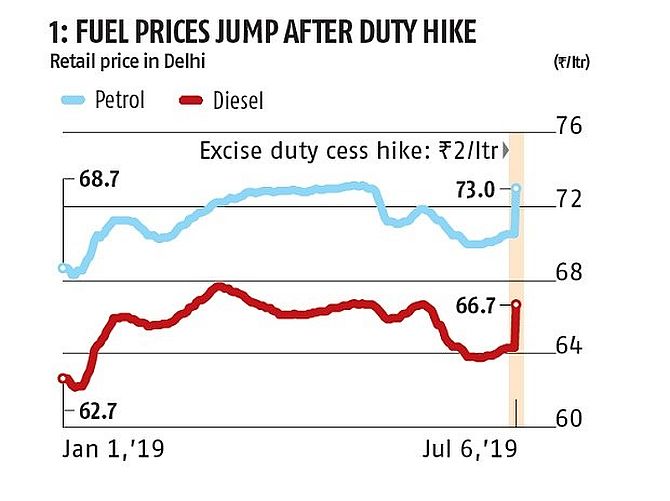

The Impact Of Excise Duty Cut On Petrol Diesel

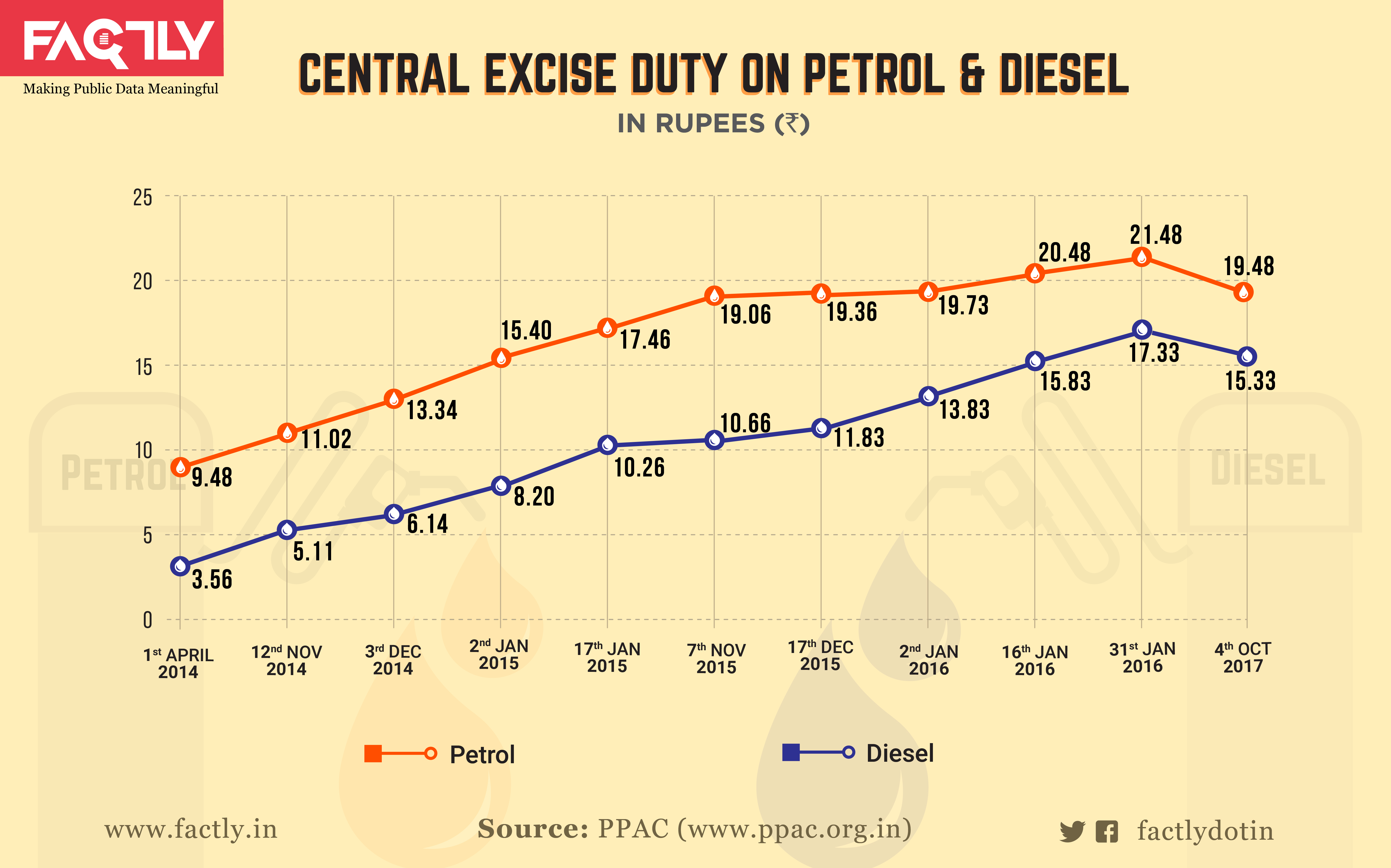

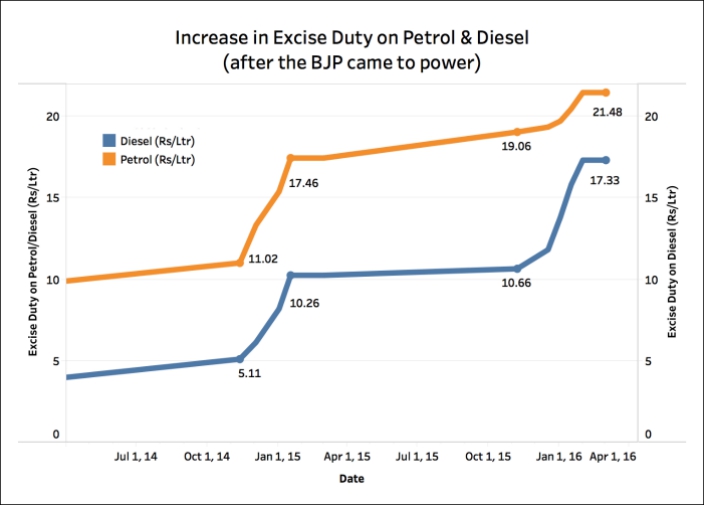

Traditionally the price of diesel and the excise duty on it used to be lower than that of petrol however over the years the gap has narrowed.

Excise duty in india. An indirect tax paid to the Government of India by producers of goods excise duty is the opposite of Customs duty in that it applies to goods manufactured domestically in the country while Customs is levied on those coming from outside of the country. On eve of the Diwali festival the Government of India announced a reduction in excise duty on petrol and. Know more about excise duty types rules payment meanings charge and chapters.

The central government on Wednesday November 3 reduced the excise duty on petrol and diesel by Rs 5 and by Rs 10 respectively which is effective starting today. This increased to Rs 204 lakh crore during April 2020-January 2021 period the Union Finance Ministry data showed. Additional - Section 3 of the Additional Duties of Excise Act of 1957 permits the charge and collection of excise duty in respect of the goods as listed in the schedule of this act.

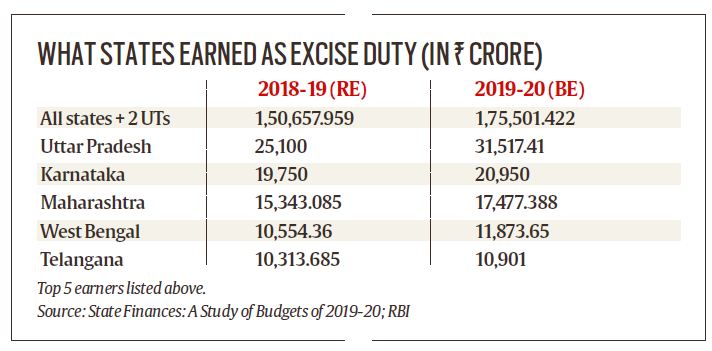

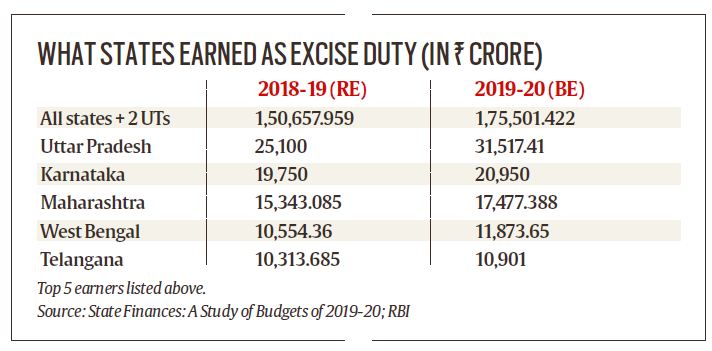

Excise Tax in India. Excise duty charges are also collected by state governments for alcohol and narcotics. The Excise Duty Act of 1944 regulates excise duty laws in India and the Central Board of Excise and Customs administers the tax.

After govt reduces excise duty states slash VAT on fuel. This tax levied on few specific goods as a substitute for the sales tax and is. In a big relief to consumers ahead of Diwali the government on Wednesday announced reduction in excise duty on petrol and dieselExcise duty on petro.

The central excise duty collected on diesel was Rs 42881 crore in 2014-15. The new reduced fuel rates will come into effect tomorrow. This duty is imposed under Section 31 a of the Central Excise Act 1944 and levied on all excisable goods in the country.

Centre slashes excise duty on petrol and diesel. The duty imposed on goods classified under the first schedule of the Central Excise Tariff Act 1985 and under Section 31a of the Central Excise Act 1944. The governments decision came on the eve of Diwali.

Excise tax is also known as excise duty. An excise tax can be defined as a kind of indirect taxation that is applicable for goods that are produced and sold within the territorial limits of a country. The Finance Ministry said the excise duty on petrol and diesel has been reduced by Rs 5 and Rs 10 respectively.

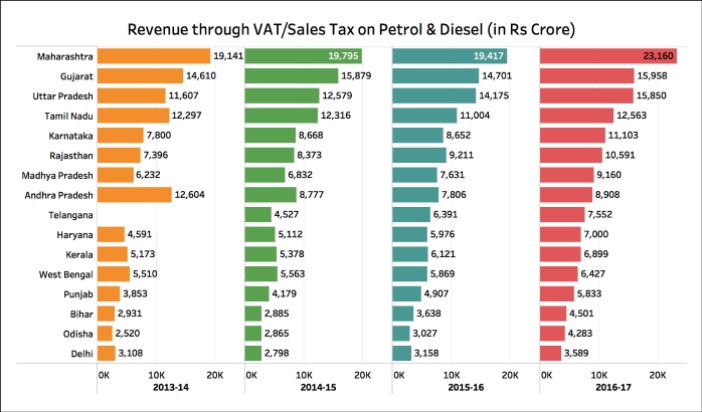

Diesel rate will be reduced from Rs 9842 per litre to Rs 8842. The government has decided to reduce the central excise duty of 5 on petrol and 10 on diesel according to people familiar with the matter. He also argued that state-levied VAT will automatically go down if excise duty is reduced by the Centre.

On eve of Diwali Government of India announces excise duty reduction on petrol and diesel. Excise duty is a form of indirect tax that is levied by the Central Government of India for the production sale or license of certain goods. Driven by the enterprising ability of Indias aspirational population the Indian economy has witnessed a remarkable turnaround post the COVID-19 induced slowdown.

Falls under the category of basic excise duty in India. NEW DELHI Nov 3 Reuters - India reduced the excise duty on petrol and diesel on Wednesday a government source said. Types of Excise Duty in India.

After govt reduces excise duty states slash VAT on fuel Assam announced a reduction in VAT on both the fuels by Rs 7 per litre with immediate effect. Central Excise Tariff Act 1985. Government of India has taken a significant decision of reducing Central Excise Duty on petrol and diesel by Rs 5 and Rs 10 pre litre respectively from tomorrow.

All sectors of the. Excise duty Excise duty cut on petrol diesel. In a big move on Wednesday the Centre reduced excise duty on petrol and diesel to bring down the prices which had been constantly increasing.

Petrol diesel to get cheaper as Centre slashes excise duty on fuel. Priyanka Gandhi slams Centre says decision due to upcoming polls. New Delhi Nov 3.

The excise duty reduction is effective from November 4 when petrol price will come down from the current rate of Rs 11004 a litre in Delhi to Rs 10504. This tax is shared between the central and state governments and charged instead of sales tax. Petrol Price Touches New High of Rs 7717.

States continue to tax alcohol in the same way. According to reports the government is likely to cut excise duty by Rs 2 to Rs 4 in next few days. The reduction in excise duty on Petrol and Diesel will also boost consumption and keep inflation low thus helping the poor and middle classes it added.

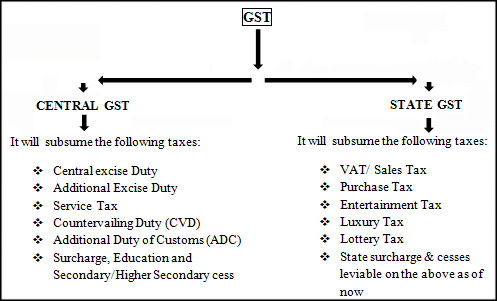

There are three types of excise duties in India-Basic Excise Duty- Sometimes referred to as Central Value Added Tax CENVAT this type of excise duty is imposed on goods classified under the first schedule of the Central Excise Tariff Act 1985. The Central Excise Act mostly provides the definitions related to excise while the Central Excise Tariff Act includes an elaborate schedule of goods on which excise is applicable and the tariff rates that apply. Latest News India.

The following are the three types of Excise Duty in India. It was imposed on manufactured items at the time of removal whereas GST was imposed on the supply of goods and services. India Business News.

It is basically different from custom duties which are levied on goods that have been produced outside a country. A day after the Central government announced a reduction in excise duty on petrol and diesel the Rajasthan government on Thursday urged Prime Minister Narendra Modi to further reduce the duty to benefit the inflation-hit public. In what could be a gift for people ahead of Diwali the Government of India today announced a cut in excise duty on petrol and diesel.

It is levied on all excisable goods in India except Salt. As a constitutionally mandated exception alcohol is not included in the scope of GST. Special - According to Section 37 of the Finance Act 1978.

Excise Duty in India is majorly governed by 2 legislations. Central Excise Act 1944. These two acts underline the laws related to the.

The excise duty on petrol has been cut by 5. Excise Duty is a kind of indirect tax that is percentage of tax paid on goods manufactured in India.

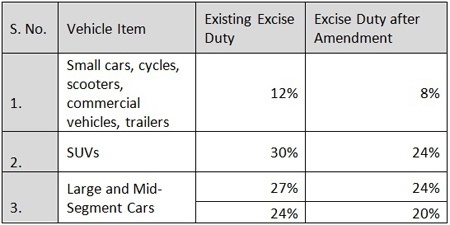

India Extends Excise Duty Cuts On Vehicles And Capital Goods India Briefing News

Central Excise Duties India Indpaedia

Repeated Hike In Excise Duty On Petro Products Surpasses Fuel Subsidy Of 15 Years Diu News

Total Central Excise Duty Rates On Cigarettes Rs Per 1000 Cigarettes Download Table

Taxes On Petrol Diesel In India Pakistan Petrol Rate Just 45 26 Ltr Simple Tax India

Government S Fuel Tax Earning Explained In Charts Rediff Com Business

Excise Duty Benefit Withdrawn Unjustified Indian Automobile Industry

How States Earn From Liquor Sales

Nearly Two Third Of The Price You Pay For Petrol Goes To Centre And States Diu News

Central Excise Duty On Petrol Diesel

Central Excise Duty Introduction And Overview Submitted By

India S Goods And Service Tax Current Scenario And Future Structure

Excise Duty On Petrol And Diesel Hiked By Rs 2 25 And Rs 1 A Litre Business Standard News

Currently Excise Duty On Diesel Is More Than 4 Times Of What It Used To Be In 2014

Currently Excise Duty On Diesel Is More Than 4 Times Of What It Used To Be In 2014

Except Petroleum No Sector Saw Growth In Excise Duty Collections In Fy14 Cag Business Standard News

Centre Earns Rs 665 Crore A Day From Excise On Oil

Nearly Two Third Of The Price You Pay For Petrol Goes To Centre And States Diu News