Excise Duty On Alcohol

Electronic equipment and cosmetics. Exceeding 05 volume but not exceeding 12 volume.

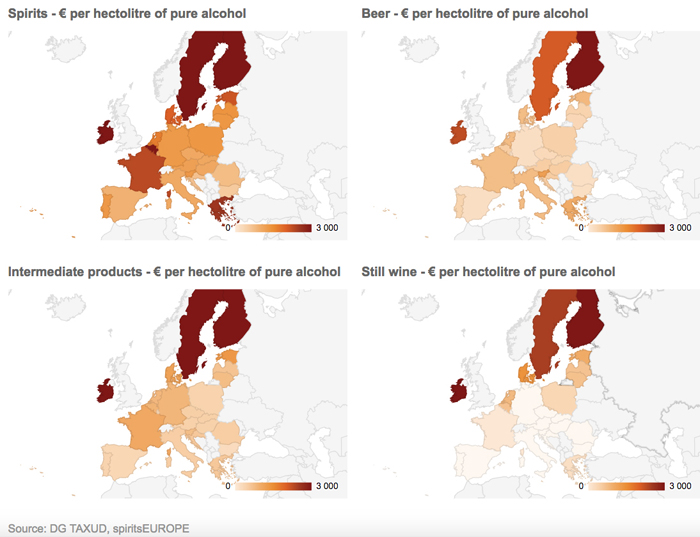

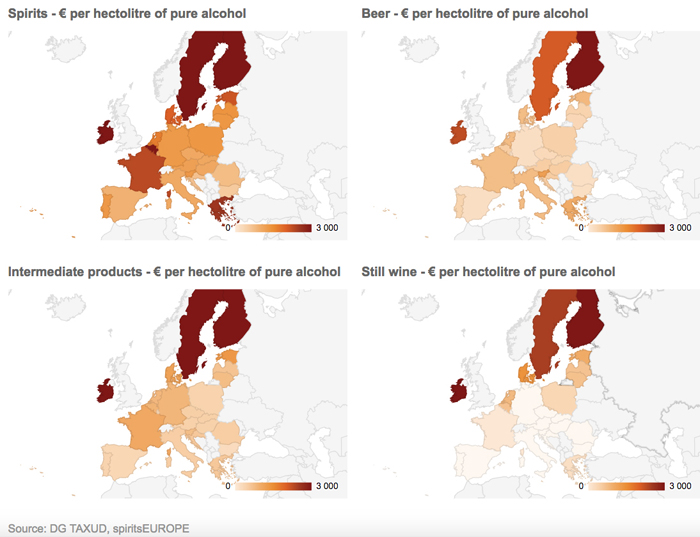

Excise Duties On Alcohol In The Eu 4liberty Eu

Beer - General Beer Duty.

Excise duty on alcohol. 23- Calculate excise duties to pay in destination to claim in your own country. 24 January 2020 Excise DutyLevy submission and payment dates for 2020 and 2021. Meaning if you buy 1 litre of liquor you pay a fixed excise duty of Rs 15.

Today it is composed of five individual taxes. Chancellor Rishi Sunak is expected to announce a landmark overhaul in the way that alcohol is. 22- Excise duties via local tax representative.

5 rows Excise duties on alcoholic beverages. Excise duties on alcohol are regulated through two. 2- From a tax point of view.

Beer - high strength. Excise Offices WHAT IS IT. 1127 per hectolitre per cent of alcohol in the beer.

Britains excise duties on alcohol to be radically overhauled. See more content about excise duties. 0 to 2000 hectolitres rate per hectolitre 3400.

Excise duty is payable by alcohol manufacturers and importers. Excise duty on alcohol and alcoholic beverages must be paid on alcohol products that are manufactured in Finland or that are sent or transported from other EU countries or from non-EU countries and received in Finland. Alcohol means beer wine fermented beverages intermediate products and other alcoholAll products belonging to CN heading 22032208 with an ethanol content of over 12 over 05 in the case of beer are deemed alcohol within the meaning of the Alcohol Tobacco Fuel and Electricity Excise Duty Act regardless of their suitability for drinking.

Electronic equipment and cosmetics. The tax type codes and excise duty rates are the same as for the type of alcohol used as the ingredient for example spirits 451 2874 per litre of alcohol. 18 October 2021 By db_staff.

Excise duties and levies are imposed mostly on high-volume daily consumable products eg. Excise duties and levies are imposed mostly on high-volume daily consumable products eg. Reduced rates of excise duty on beer containing more than 25 of absolute ethyl alcohol by volume.

The exception being when insignificant amounts are transported by an individual for personal consumption and is under the Personal Allowance limit. Beer duty spirits duty cider duty wine duty and made-wine duty1. Assuming the customs and excise duties for beer is S15 and S50 for per litre of alcohol.

1- Definition of Alcoholic Beverages 2- From a tax point of view. Excise duty must be paid when products are imported to Finland or. Rate of duty.

Excise duty must be paid on all alcoholic drinks before it can be released into Free Circulation for resale or any other commercial use. Duties payable Total quantity in litresL x Customs or excise duty rate X the Percentage of alcoholic strength. Both customs and the excise duties are levied on the import of beer.

Spirits may generally be defined as ethyl alcohol obtained from the distillation of various base products to an alcoholic strength of usually more than 60 per cent per volume and is subject to the payment of Excise Duty if consumed as liquor within the Southern African Customs Union SACU. It is calculated on a per-unit basis. Alcohol type Rate per hectolitre per cent of alcohol in the beer.

Exceeding 12 volume but not exceeding 28 volume. Excise duty is a tax levied to discourage the consumption of a product. 1- Definition of Alcoholic Beverages.

See more content about excise duties. 21- Distance selling of alcoholic beverages 22- Excise duties via local tax representative 23- Calculate excise duties to pay in destination to claim in your own country 24- Drawbackrefund of excise duties 25 INTRASTAT. Petroleum and alcohol and tobacco products as well as certain non-essential or luxury items eg.

Petroleum and alcohol and tobacco products as well as certain non-essential or luxury items eg. Unlicensed manufacture of excisable alcohol licensed manufacture with unreported excise duty selling duty-unpaid. Exceeding 75 abv - in addition to the General Beer Duty.

We index the. The primary function of these duties and levies is to ensure a constant stream of revenue for the State. There are several activities involving excisable alcohol that attract our attention because they are offences under the Excise Act 1901 Excise Act where penalties may apply including.

7 rows We express excise duty rates per litre of alcohol LAL for alcoholic products. 4257 per litre of alcohol in the spirits. Annual production volume increments Effective April 1 2021 April 1 2020 to March 31 2021 April 1 2019 to March 31 2020 April 1 2018 to March 31 2019 March 23 2017 to March 31 2018.

Company Y imports 80 litres of beer with alcoholic strength of 5. 21- Distance selling of alcoholic beverages. 11 Alcohol duty is a long-standing system of taxes with its origins in the 1643 Excise Ordinance levied by Parliament during the English Civil Wars.

Eu Excise Duty On Alcohol Distilled Spirits Taxes In Europe 2021

Share Of Revenues From Excise Duties On Alcohol And Alcoholic Beverages Download Scientific Diagram

Comparing Alcohol Taxation Throughout The European Union Angus 2019 Addiction Wiley Online Library

Spiritseurope Taxation Economy Key Data

Excise Duties On Alcohol In The Eu 4liberty Eu

India Estimated Excise Duty On Alcohol By State 2020 Statista

Excise Duty Based On Alcohol Volume Liquor Sale Decreased 11 Per Cent Mangala

Europe Pays The Highest Alcohol Tax Against The Rest Of The World The World Financial Review

Europe Beer Tax Map European Beer Taxes Tax Foundation

Share Of Revenues From Excise Duties On Alcohol And Alcoholic Beverages Download Scientific Diagram

How Liquor Is Filling Bihar Government S Coffers Businesstoday

Excise Duties On Alcohol In The Eu 4liberty Eu

European Union Alcohol Excise Revenues And Duties Download Table

How Alcohol Importers Are Losing Out On Excise Tax Benefits Sevenfifty Daily

Excise Duty Rates Imposed On Alcohol And Tobacco Products In Poland Download Table

Whisky Alcohol Tax Revenue Excise Duty Stock Photo Alamy

Eu Excise Duty On Alcohol Distilled Spirits Taxes Tax Foundation

Boring Beer Tariffs And Regulations And Their Impact On A Country S Beer Industry