Excise Duty Rate

Excise duty is set by the States of Guernsey in accordance with local government requirements. Excise duty rate chart.

The Results Regarding The Impact Of The Excise Duty Rate Increase On Download Table

The CPI indexation factor for rates from 2 August 2021 is 1014.

Excise duty rate. It also includes special provisions such as reduced rates for small breweries and small distilleries certain products and geographical regions. The new rates which take effect on 1 October 2020 are based on an average inflation rate of 494. The categories of alcohol and alcoholic beverages subject to excise duty.

Excise Duty Rates in euros. We express excise duty rates per litre of alcohol LAL for alcoholic products. Excise duties in Austria for beer.

An overview of the most common CN codes tax and excise duty codes and excise duty rates can be found in the Attachment 7 on the TarBel website. A reduction in Austria will only be granted to independent breweries with a maximum annual production volume of 50 000 hl and the tax difference may be reimbursed at the request of the person who has paid the tax standard rate in Austria. At the moment excise duty is charged at 1236 but it varies based on the kind of products.

Heres how the rules work if your car was first registered on these dates. The rates are reviewed annually by the States of Guernsey and set at budget time which is usually in October. Further the Act empowers the Commissioner General to adjust specific excise duty rates annually because of inflation.

2 Excise duty shall be charged at the rate specified in the First Schedule for the excisable goods or services in force at the time the liability arises for excise duty as determined under section 6. As of 1 March 2019 a rate of 50 is applied to other alcoholic beverages produced by small alcoholic beverage distilleries. Liability to pay excise duty.

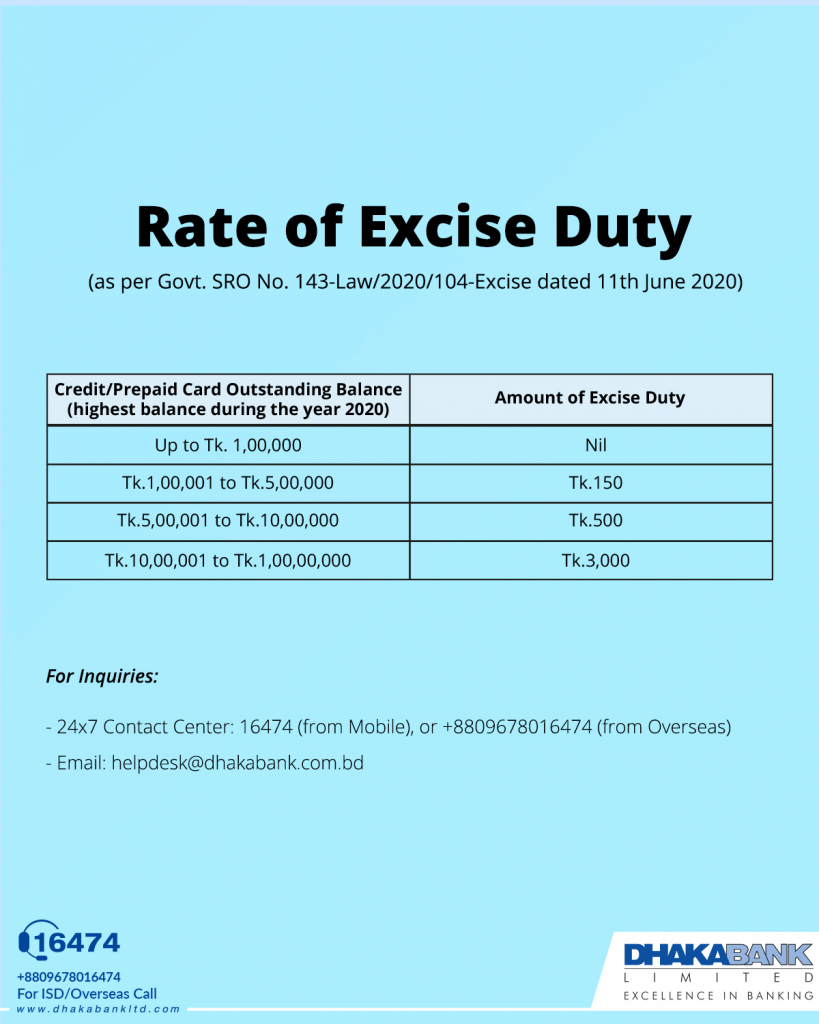

Current Data Attachment 7 link is external. Highest Balance CreditDebit in Taka Excise Duty in Taka 0 -100000 NIL 100001 - 500000 150 500001 - 1000000 500 1000001 - 10000000 30 00 10000001 - 50000000 15 000 50000001 and above 40 000 HSBC Bangladesh always seeks to comply with all. National Board of Revenue NBR also directed through Large Taxpayers Unit LTU to commercial bank for deducting Excise Duty from Loan Account also.

PDF 10-Oct-2019 Show less Show older versions. Excise duty is applied to alcohol tobacco and some fuels imported into or manufactured in the Bailiwick. Exemption of excise on Air ticket for disabled freedom fighters.

Reduced rates of excise duty on beer containing more than 25 of absolute ethyl alcohol by. The rates applicable to excise duty are specified as per the central excise tariff rules. Excise duty shall become due and payable in respect of.

Link is external. Exemption of excise duty on the deposit of accounts of farmer opened for Tk. They also provide an overview of the rates of duty applicable for various licences.

Reduce the excise duty in percent that equals to 168607 divided by the produced amount in hl plus 443. Vehicle Excise Duty is linked directly to your car van or motorhome and the cost varies depending on vehicle age list price and CO2 emissions. Rate per litre of pure alcohol.

Deposit to State account. The AT standard rate is 2 hectolitre degrees Plato. Reduce the excise duty by 50 percent.

Excise Duty on Bank deposit and Air ticket. We index the excise duty rates for alcohol twice a year in line with the consumer price index CPI. On 29 July 2020 the Council a series of new rules Council Directive 20201151 amending Directive 9283EEC on the harmonization of the structures of excise duties.

The rate of excise duty on cigarettes is EUR 34604 per 1000 cigarettes together with an amount equal to 891 of the price at which the cigarettes are sold by retail or EUR 39505 per 1000 cigarettes whichever is the greater. The excise duty rates may also change as a result of law changes. Reduce the excise duty in percent that equals to 1429 minus produced amount in hl divided by 14003.

The basis on which the excise duty is calculated. 410 per by volume but not less than 1520. 3 The excise duty payable a under subsection 1a shall be payable by the licensed manufacturer.

In some cases we observed that Branches are confused while deducting Excise Duty. Generally indexation occurs on 1 February and 1 August. The different rates are known as car tax bands road tax bands or VED bands.

2 3700 and 20000. 0 5 10 17 15 20 25 30 and 50. Full or unrebated rate of excise duty per litre Rebate per litre Type of tax code.

Type per 1 January 2019. For further information in relation to the operation of each excise duty please see the Related topics section. The current excise duty rates can be consulted via Fisconetplus.

The rate of excise duty on cigars is EUR 394811 per kilogram. Budget Excise Duty Rates A summary of rates changes to excisable products announced as part of the Budget. At the moment excise duty is charged at 1236 but it varies based on the kind of products.

3 20000 hl. Excise Duty Rates on Energy Products and Electricity Manual The Tax and Duty Manual on Excise Duty Rates on Energy Products and Electricity has been updated to reflect increases in rates of Mineral Oil Tax MOT on. 1 3700 hl.

Specific excise duty rates were last amended vide Legal Notice 109 of 2019 which was effective 1 July 2019 and considered average inflation rate of 515. The Cabinet Secretary may adjust by increasing or decreasing the rate of excise duty on excisable goods or services by an amount not exceeding 10. The following pages provide an overview of the current excise duty rates.

How To Define Duty Rates Company Group Ledger Level Excise For Manufacturer In Tallyprime Tallyhelp

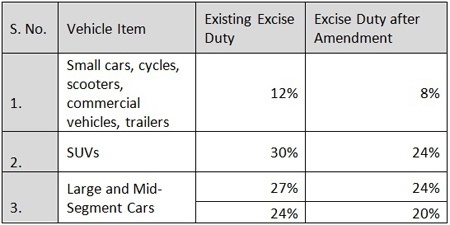

Vehicle Excise Duty Rates Download Table

Total Central Excise Duty Rates On Cigarettes Rs Per 1000 Cigarettes Download Table

India Extends Excise Duty Cuts On Vehicles And Capital Goods India Briefing News

Rate Of Excise Duty Dhaka Bank Excellence In Banking

Excise Duty And Realities Of Small Investors Print Version

জ ন ভ ল Excise Duty Rates 2017 18

Excise Duty Rates Imposed On Alcohol And Tobacco Products In Germany Download Table

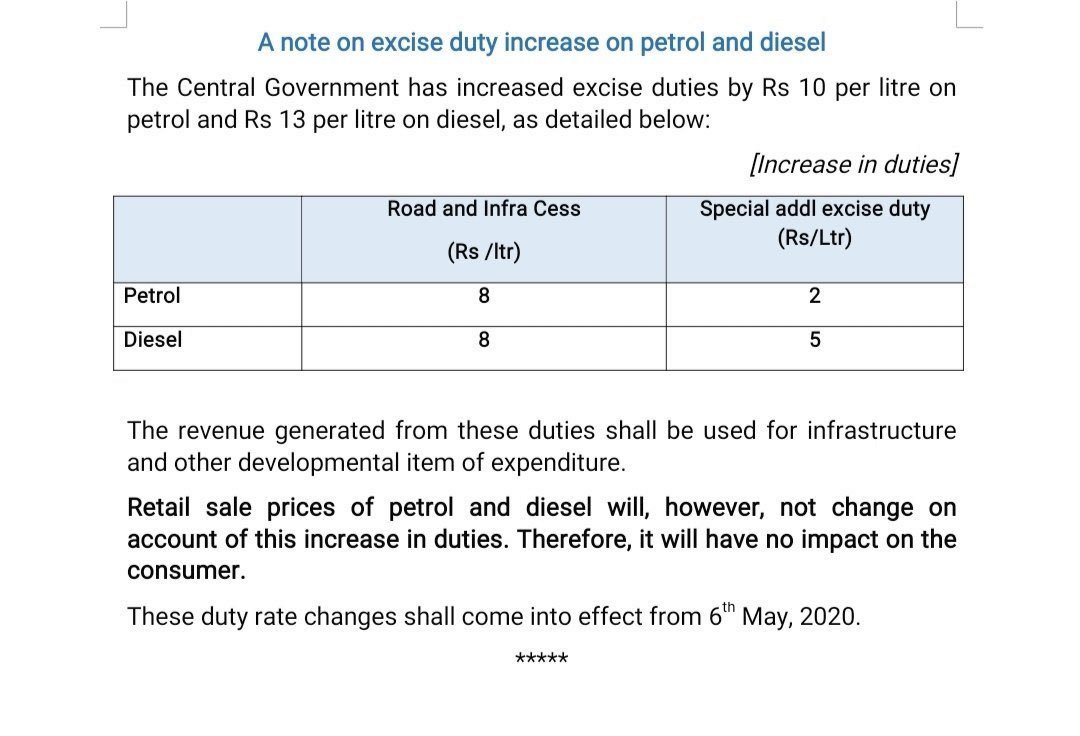

The Square Post On Twitter Central Government Has Increased Excise Duties By Rs 10 Per Litre On Petrol And Rs 13 Per Litre On Diesel Retail Sale Prices Of Petrol And Diesel

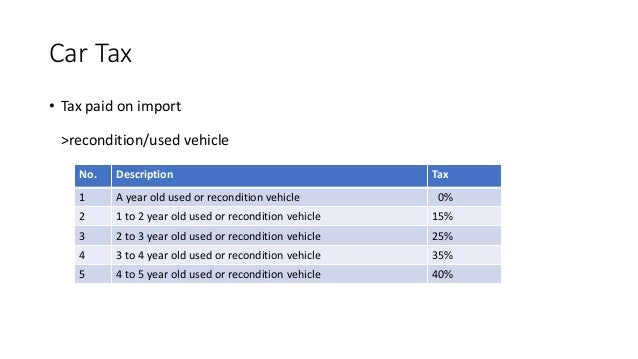

Car Tax Excise Duties On Some Fuel And Alcohol Bangladesh

The Impact On Gasoline And Diesel Excise Duty Rates Of A Full Download Table

Structure Of Federal Excise Duty On Cigarettes Download Scientific Diagram

Myriads Of Taxes Bleed Savers Dry

Excise Duties On Alcohol In The Eu 4liberty Eu

Excise Duty Rates Imposed On Alcohol And Tobacco Products In Poland Download Table

Excise Duties On Alcohol In The Eu 4liberty Eu

What Is Excise Duty Excise Duty Definition Excise Duty News